Oahu

Oahu is Hawaii's most populated island a.k.a. "The Gathering Place."

As we compare Hawaii's real estate market from August 2022 to July 2023, it's evident that there's been an uptrend in closed sales and median prices across multiple categories on Oahu, Maui, Big Island, and Kauai. While interest rates are down from their highs back in May, low inventory continues to keep median prices up.

Nationally, the existing home sales scenario paints a different picture, with a 2.2% month-over-month decline in closed sales. This translates to a significant 16.6% drop compared to the same period last year. Yet, much like the situation in Hawaii, the scarcity of available homes intensifies the competition among potential buyers, inevitably leading to an uptick in property prices.

In our mission to provide you with the most accurate real estate insights, we compile data from reliable sources, including Hawaii Information Service, HiCentral MLS, Ltd., and REALTORS® Association of Maui. This approach ensures that you have a clear and well-rounded view of the market.

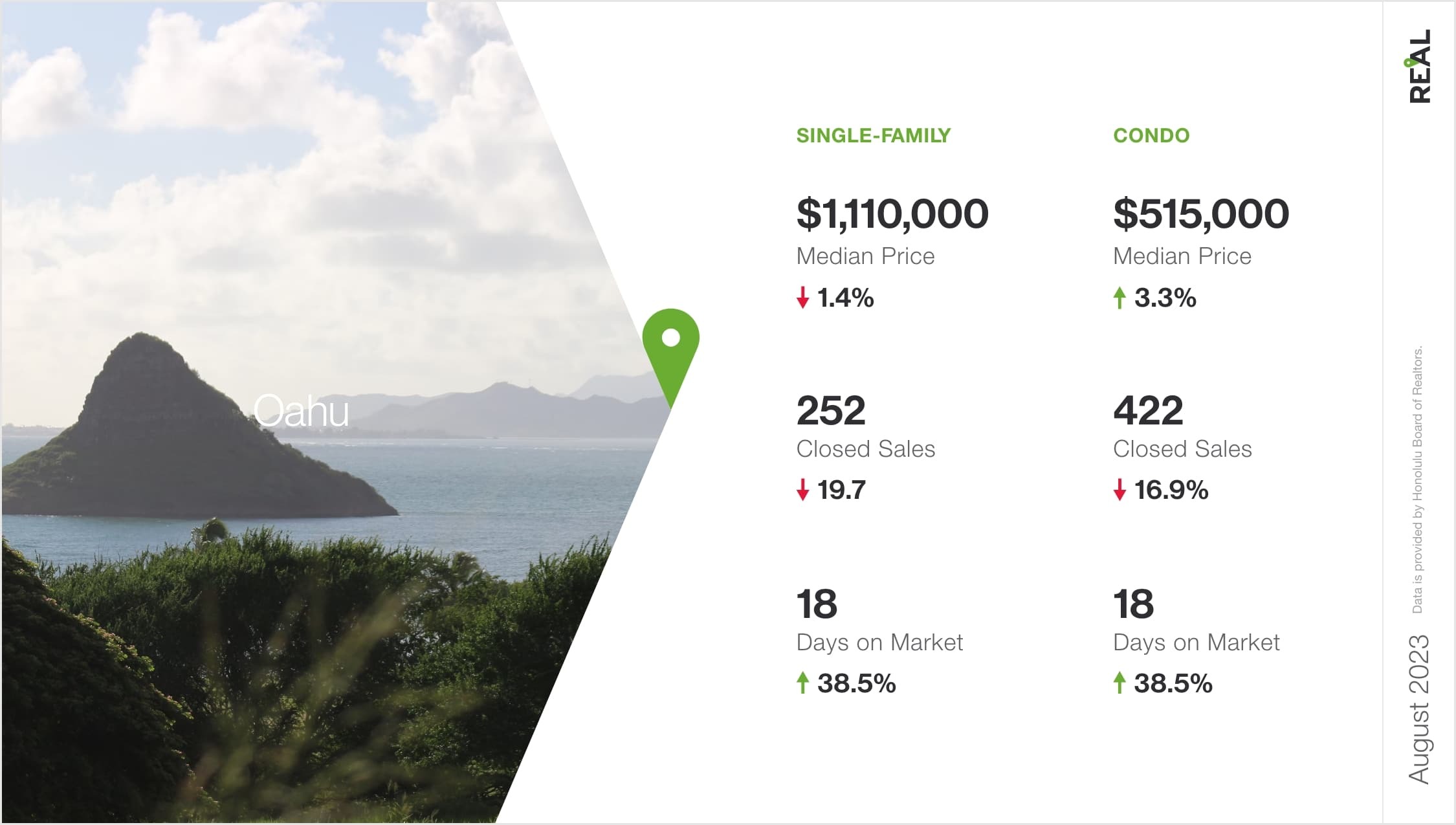

On Oahu, closed sales of both single-family homes and condos experienced a year-over-year decline, with drops of 19.7% and 16.9%, respectively. However, there was a noticeable uptick in single-family home sales when compared to the previous month, with a 12.5% increase, while condo sales remained relatively steady. Median sales prices showed differing trends, with single-family homes witnessing a 1.4% dip to reach $1,110,000 in comparison to 2022. Meanwhile, condos saw a 3.3% increase, reaching a median sales price of $515,000.

Specifically with single-family homes on Oahu, a noteworthy shift in sales volume occurred. Specifically, homes within the $900,000 to $1,199,999 price range saw a substantial downturn, witnessing a 39.2% year-over-year decrease in sales volume. Conversely, a more affordable bracket, ranging from $600,000 to $899,999, displayed a contrasting trend. Here, sales experienced a modest uptick of 13.1%, reflecting the closing of eight more transactions in comparison to the previous August.

Turning to the condominium market on Oahu, there were distinct trends across different price points. Notably, the more budget-friendly price range spanning from $100,000 to $499,999 witnessed the most substantial decline in sales volume, experiencing a 24.3% year-over-year drop. Conversely, the higher-end condominiums, priced at $900,000 and above, maintained a relatively stable sales volume, showing little change from the previous year.

Register below and get our monthly reports on new and existing homes in Hawaii.

By registering, you agree to our Privacy Policy.On Maui, new listings for single-family homes witnessed a substantial decline, plummeting by 49.1% compared to last year. In contrast, pending sales showed a slight increase of 1.6%. However, available inventory experienced a significant drop of 31.5%. The median sales price for single-family homes surged impressively, marking a 21.7% increase to reach $1,197,500. Days on the market for single-family homes decreased notably by 16.8%, indicating a faster sales pace.

In Maui's condo market, new listings declined by 31.4%, a substantial decrease. However, pending sales saw a significant drop of 37.1%. Condo inventory decreased by 12.1%. The median sales price for condominiums, on the other hand, faced a 4.3% decrease, falling to $773,750. Condos experienced a notable increase in days on the market, with a rise of 36.7%, suggesting a slower turnover.

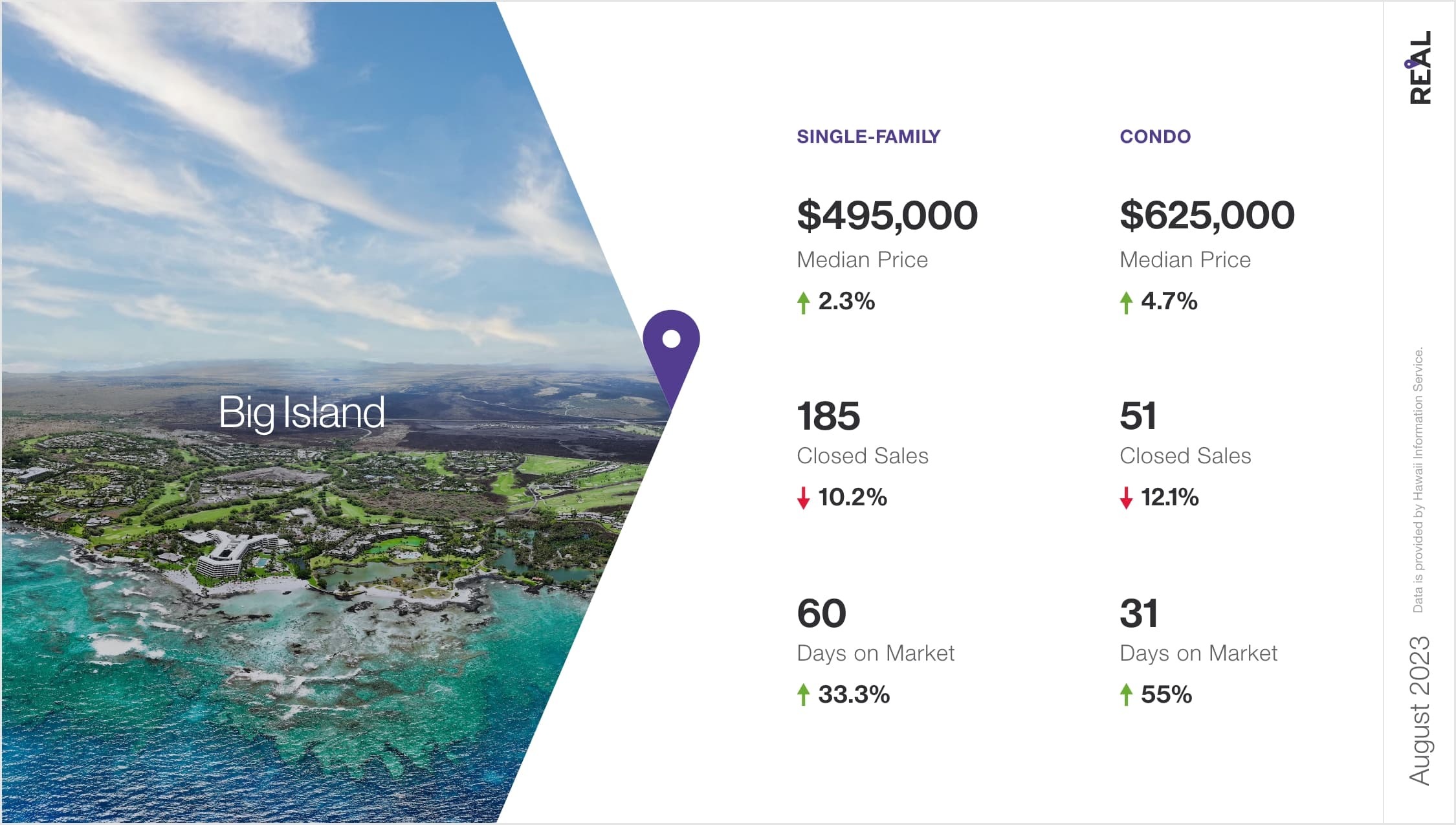

On the Big Island, the single-family home market remains vibrant. In August, it recorded a total transaction volume of $183,758,875, comprising 185 transactions. Puna proved to be particularly bustling, with 81 transactions taking place in this area. The median price for single-family homes remained stable, holding at $495,500 from the previous month. These homes typically spent an average of 60 days on the market, just one day less than in July.

Shifting our focus to the condominium market on the Big Island, we find an interesting dynamic. August saw 51 closed sales in this segment, resulting in a total transaction volume of $52,762,400. The median price for condos stood at $625,000, reflecting the diversity in the island's real estate offerings. Days on the market (DOM) for condos averaged just 31 days, showcasing their popularity among buyers. North Kona and South Kohala continued to be prominent areas for condo sales.

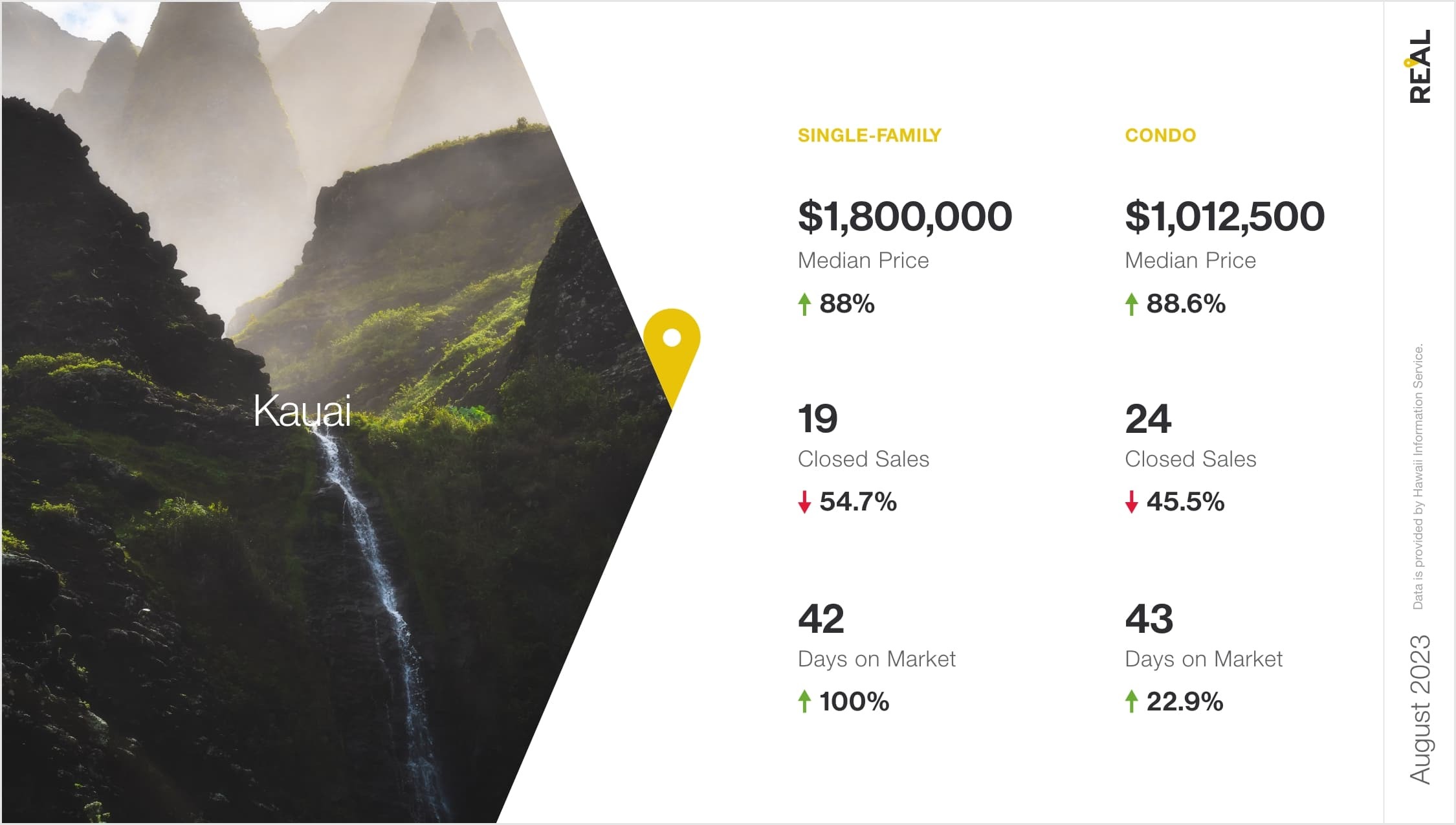

In Kauai's real estate market, August 2023 witnessed 19 closed sales, amounting to a total volume of $43,574,000. These properties typically found buyers within an average of 42 days. A significant portion of these sales occurred in Hanalei and Kawaihau. Notably, August saw a slight uptick in sales compared to the previous month, accompanied by a substantial increase in median prices, marking an approximate $500,000 surge.

In the condo segment of Kauai's real estate market, there were 24 units sold in August, mirroring the sales figures from the previous month. Of these, 8 were in Hanalei, and 6 were in Koloa. While the median price saw a marginal decline from the previous month, the average Days on Market (DOM) decreased by approximately 20 days, indicating increased buyer activity in this category.