Congratulations! Your offer has been accepted on a home in Hawaii. But before the keys are in your hand, you will need to go through the escrow process, which can last from 30 to 60 days. And when you close on a home in Hawaii, the escrow process usually involves interaction with a title company. Then after closing, escrow may still be a part of monthly payments for the duration of your mortgage loan.

What is the escrow process?

In short, in Hawaii, the closing process generally is conducted through escrow. In Hawaii, escrow services are typically provided by title insurance companies, but escrow can also be done through trust companies, lenders, Hawaii attorneys, or Hawaii real estate brokers.

An escrow is a process by which a home deed is delivered to a third person, usually the title company, which will then be delivered to the grantee, or the home buyer, upon the performance or fulfillment of a certain condition or instructions, like paying off the mortgage loan and all the closing costs.

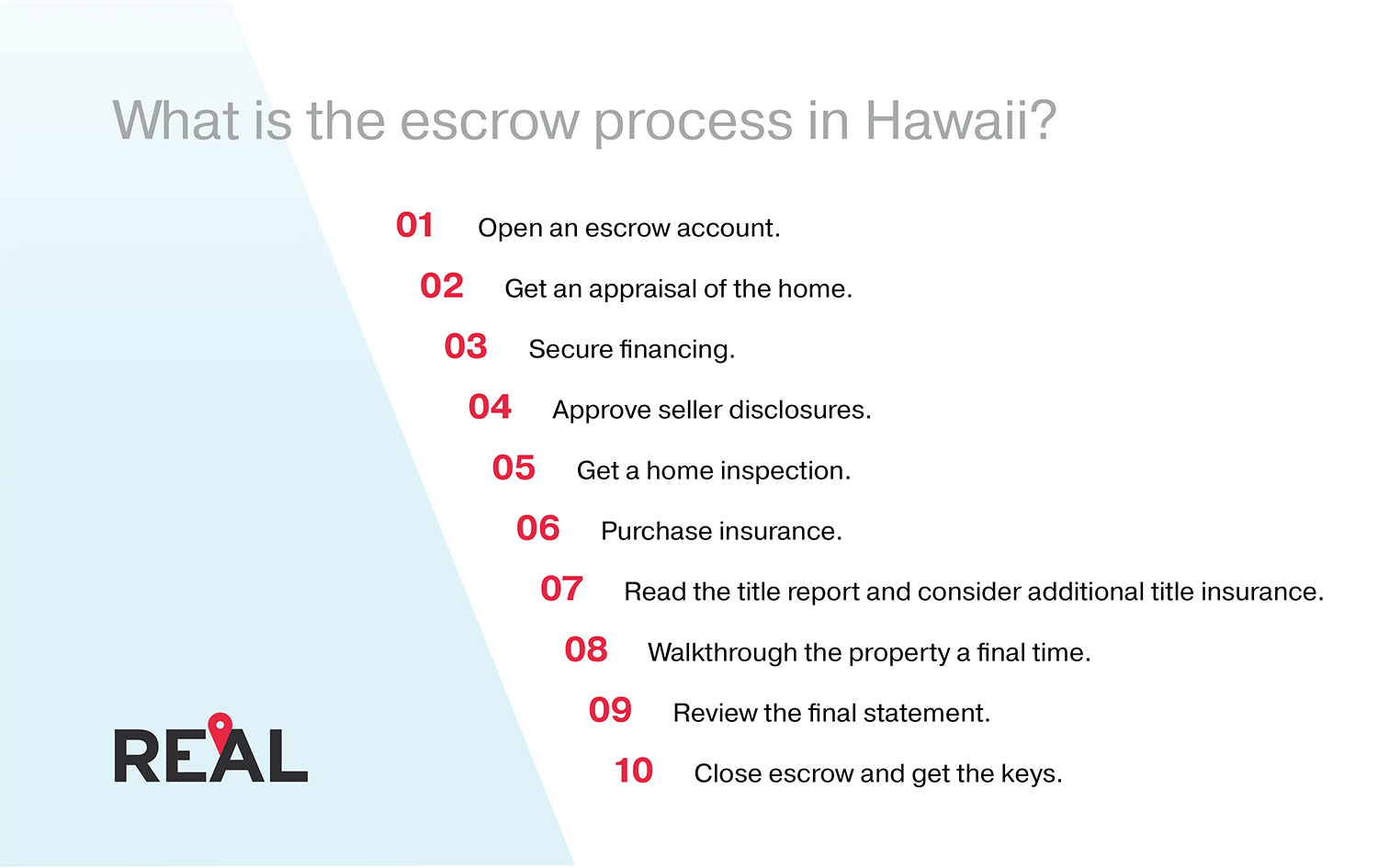

Here are some of the steps involved during the escrow process:

- Open an escrow account. Once negotiations are completed and an offer on the home is accepted, your real estate agent will usually collect a check for your earnest money. This earnest money amount will be stated on the Hawaii Purchase Contract in Section B. This earnest money deposit will be deposited to the title company or other escrow entity specified in the purchase agreement. In Hawaii, the seller will typically choose the title company where escrow will occur; however, there are cases where the buyer has the option to specify their preferred third-party escrow agent.

- Get an appraisal of the home. The appraisal of the home will assist the lender in deciding if they want to finance your home purchase.

- Secure financing. You most likely were already preapproved by a bank or mortgage broker company before having your offer accepted. Once the lender receives the property address, they will prepare an estimate detailing the loan amount, interest rate, closing costs, and more; you will be asked to sign these documents – either in person or digitally.

- Approve seller disclosures. The seller will give the buyer a written notification of any material facts on the property, such as an illegally built structure. These are often mentioned in the listing and the buyer will have to sign off on receiving notification of these disclosures.

- Get a home inspection. While the home inspection is not required, it is highly recommended. The inspection often gives you clout to negotiate for more money from the seller, also known as seller concessions. What are seller concessions? They are closing costs that the seller agrees to pay and are typically negotiated during the closing phase; they could be an amount to make certain repairs or they could be for certain closing costs, like the appraisal, title insurance, or recording fees. Termite inspections are also required in Hawaii, and if termites are found, the home will need to be tented – at the seller’s expense.

- Purchase insurance. Your mortgage broker or real estate agent may have referrals to different insurance agents, or you can do your own research. In Hawaii, homes always have homeowner’s insurance as well as hurricane insurance, and if you are zoned in a VE or AE or another flood zone, you may need to purchase flood insurance as well. The insurances as well as the city and county taxes can be lumped into your monthly payment and paid through an escrow account. The mortgage lender will require proof of adequate insurance before funding your loan.

- Read the title report and consider purchasing additional title insurance. The title report and the title insurance, which are facilitated through the title insurance company, are required by the lender. When reading the title report, ensure you are purchasing a home that does not have a “cloud” or “defect” on the title.

- Walkthrough the property a final time. Right before the final closing date, your real estate agent will typically walk you through the property to make sure the home is cleaned, and specified items are fixed. It is difficult to back out of the agreement at this stage unless the home has sustained serious damage.

- Review the final statement. Carefully look through the HUD-1 Form and compare it to the estimate given previously. Look at the loan terms, closing costs, and the breakdown of your monthly payment amounts. Ask questions if you have them!

- Close escrow and get the keys. Near the end of the closing process, both the buyer and the seller will need to go to the title insurance company at separate dates to sign a ton of paperwork, even some that might have previously been signed digitally. To cover any of the closing costs or down payment amounts, you will need to bring a cashier’s check from the bank or wire transfer the funds to the escrow agent. The lender will wire the loan funds to escrow so the seller, and, if pertinent, the seller’s lender, are paid.

What does a title company do?

The above are the basic steps in the escrow process, and during that process, a third party or escrow agent, typically a title insurance company in Hawaii, follows the escrow process instructions outlined in the Purchase Contract. The title insurance company works with all the parties involved – the buyer, the seller, the real estate agents, the mortgage lender, the insurance companies, and more – to ensure the provisions in the Purchase Contract are carried out according to Hawaii law.

The escrow agent will also prepare the closing statements for the buyers and the sellers, outlining who pays what and who gets what (also known as debits and credits). The escrow agent also ensures the brokers are paid as well as the lenders and title insurance companies.

Hawaii’s Escrow Act of 1967 requires an escrow company to:

- be incorporated.

- either maintain $50,000 in capital or obtain bonding for this amount.

- be subject to an annual audit.

- give neither referral fees nor rebates.

- deposit monies into a client trust fund (i.e., a trust account).

In addition to acting as a third party during the closing process, a title insurance company also researches titles and issues title insurance policies.

When a title insurance company receives a request for title insurance, a title examiner performs a title search in their title plant (a collection of records affecting titles) and in the recorder’s office to determine the condition of the title. The examiner researches to see if there are any flaws on the title, including terms such as encumbrances, liens, judgments, title defects, and others. When the search is completed, the title insurance company issues a preliminary title report, disclosing the current findings of the title to the lender and the buyer.

Two forms of title insurance coverage are available and are purchased during the escrow process: standard coverage and extended coverage. Standard coverage is usually used in the owner’s policy and insures against any title issues that are of public record, like a mortgage on the title, unless this issue is explicitly excluded from the policy coverage. Extended title insurance is usually issued to protect the lender and will cover issues not shown in the public records, such as owners who are not on the deed or unrecorded easements or encroachments.

What should you not do during escrow?

To make sure escrow goes as smoothly as possible and you have your keys in your hand as quickly as possible, do NOT do the following:

- Don’t miss deadlines.

- Don’t forget to check your email and voicemails frequently.

- Don’t forget to arrive at the title company early on the closing date.

- Don’t be afraid to ask questions.

- Don’t forget to ask about the final amount you will need to bring to escrow on your final closing date.

- Don’t write a simple check; you will need to get a cashier’s check from the bank for your final down payment and closing costs or wire the money.

- Don’t forget to thank all the people who made your Hawaii real estate dream come true!

While there are a lot of steps in the escrow process, in Hawaii the escrow agent at the title insurance company can typically handle all these steps seamlessly, guiding you on your way to your Hawaii home.